POWER+

PennyMac Loan Services, LLC

Creative Brief

A next-gen mortgage broker portal informed, designed, and developed with direct user feedback to provide speed, transparency, and control over the mortgage origination process.

My Contributions

I took the lead on several key features including Settlement Collaboration, Multi-factor Authentication, Help Desk, and Conditions. My time and energy was split between four agile teams, constant and consistent communication and collaboration was vital to accomplishing these chunks of work.

Tools

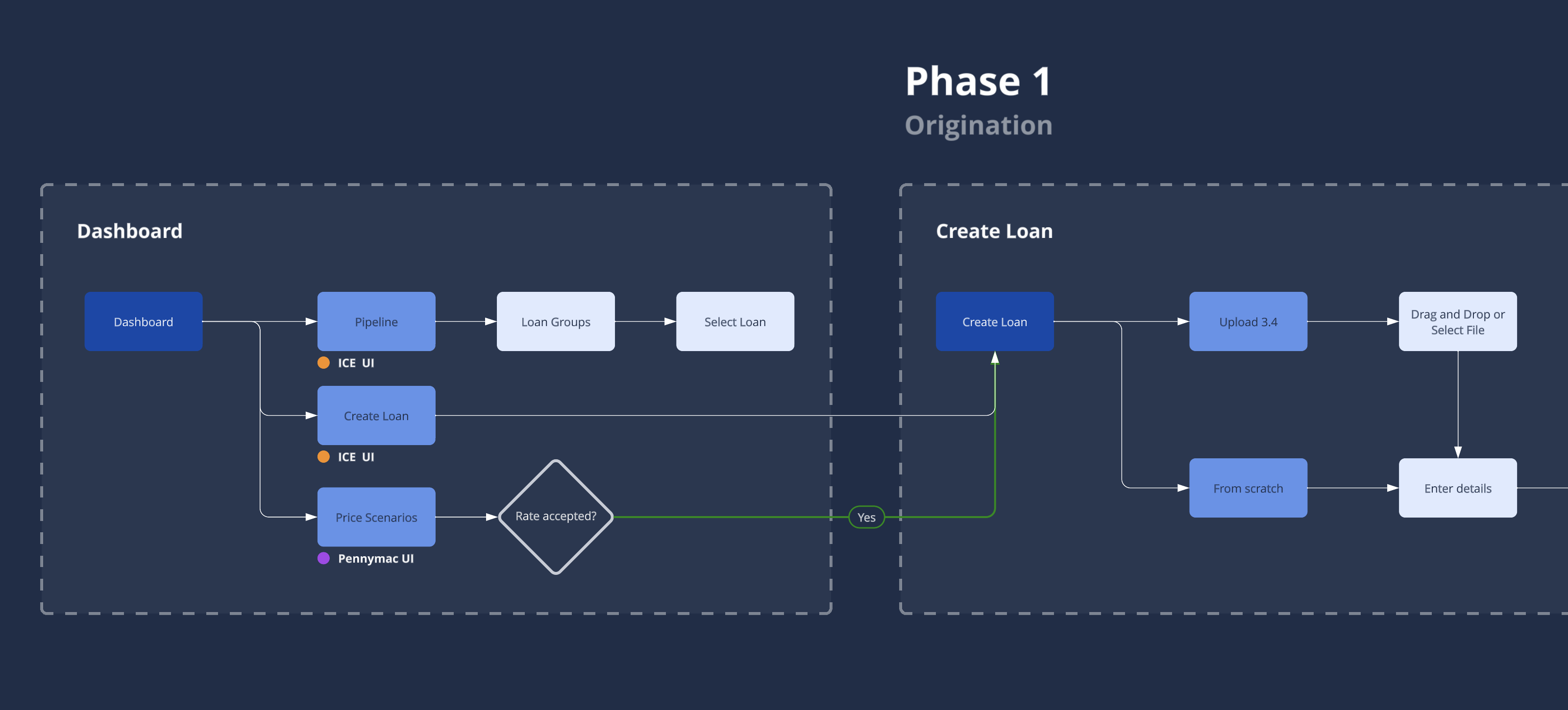

The Challenge

The biggest challenge I faced with this feature was accommodating three different user personas with different needs and goals. They all had to communicate with each other while knowing when it was their turn to take action. This complicated the user flow and made it difficult to show a linear progression.

The Approach

I came into this feature early on, so I was able to create simple diagrams outlining each user’s journey through the collaboration process. Cross-examination helped identify intersections to which I needed to provide each user with appropriate real-time notifications and actions.

The Solution

A document editing and collaboration-first experience with real-time chat and notification functionality enabling each user to clearly and efficiently move through the closing process.

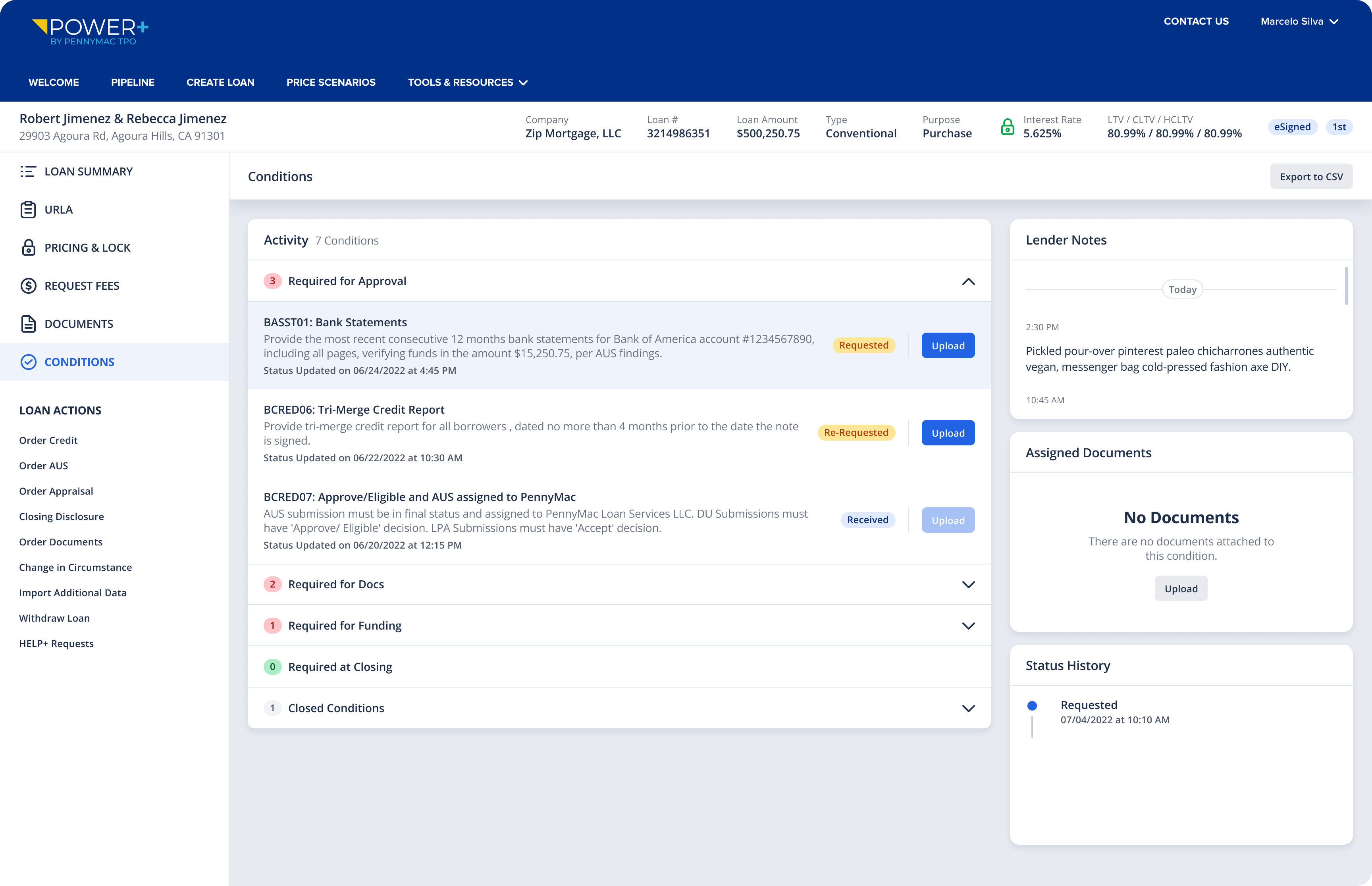

The Challenge

With this feature, I had to create an experience that would replace a workaround. The main challenge was finding a way to steer them to utilize this new way of fulfilling document requests from Pennymac.

The Approach

I conducted stakeholder interviews to gain valuable insights into our current workaround. This feature required me to understand the data, truly empathize with the user, and know the importance of where this piece fits into the ecosystem.

The Solution

After several rounds of wireframe iterations, we landed on a collapsible table displaying a condition code, reason for request, status, and call-to-action. This feature had great adoption, we saw an almost 100% success rate when analyzing Fullstory data.